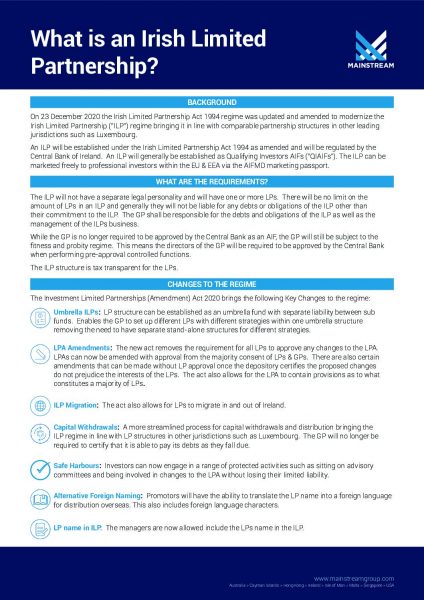

What is an Irish Limited Partnership?

On 23 December 2020, the Irish Limited Partnership Act 1994 regime was updated and amended to modernize the Irish Limited Partnership (“ILP”) regime bringing it in line with comparable partnership structures in other leading jurisdictions such as Luxembourg.

An ILP will be established under the Irish Limited Partnership Act 1994 as amended and will be regulated by the Central Bank of Ireland. An ILP will generally be established as Qualifying Investors AIFs (“QIAIFs”). The ILP can be marketed freely to professional investors within the EU & EEA via the AIFMD marketing passport.

What are the requirements?

The ILP will not have a separate legal personality and will have one or more LPs. There will be no limit on the amount of LPs in an ILP and generally they will not be liable for any debts or obligations of the ILP other than their commitment to the ILP. The GP shall be responsible for the debts and obligations of the ILP as well as the management of the ILPs business.

While the GP is no longer required to be approved by the Central Bank as an AIF, the GP will still be subject to the fitness and probity regime. This means the directors of the GP will be required to be approved by the Central Bank when performing pre-approval controlled functions.

The ILP structure is tax transparent for the LPs.

Changes to the Regime

The Investment Limited Partnerships (Amendment) Act 2020 brings the following Key Changes to the regime:

- Umbrella ILPs: LP structure can be established as an umbrella fund with separate liability between sub funds. Enables the GP to set up different LPs with different strategies within one umbrella structure removing the need to have separate stand-alone structures for different strategies.

- LPA Amendments: The new act removes the requirement for all LPs to approve any changes to the LPA. LPAs can now be amended with approval from the majority consent of LPs & GPs. There are also certain amendments that can be made without LP approval once the depository certifies the proposed changes do not prejudice the interests of the LPs. The act also allows for the LPA to contain provisions as to what constitutes a majority of LPs.

- ILP Migration: The act also allows for LPs to migrate in and out of Ireland.

- Capital Withdrawals: A more streamlined process for capital withdrawals and distribution bringing the ILP regime in line with LP structures in other jurisdictions such as Luxembourg. The GP will no longer be required to certify that it is able to pay its debts as they fall due.

- Safe Harbours: Investors can now engage in a range of protected activities such as sitting on advisory committees and being involved in changes to the LPA without losing their limited liability.

- Alternative Foreign Naming: Promotors will have the ability to translate the LP name into a foreign language for distribution overseas. This also includes foreign language characters.

- LP name in ILP: The managers are now allowed include the LPs name in the ILP.

How is it structured?

Want to know more?

Check out our flyer below or speak to your client services manager.