Lift and Shift Service

Explore lower cost operational models for your large scale wealth management business with Mainstream

Innovate and grow your funds with the scale of Mainstream

We know asset managers are under increasing pressure to manage costs and automate processes.

We understand the heavy compliance and monitoring requirements of running a unit registry (transfer agency).

Mainstream’s enterprise solutions can free you from the constraints of your in-house operations and improve services to your services.

We offer you tailored fund administration solutions, supported by leading fund technology and our proprietary processes. We can design, transition and optimise your ideal operational environment and registry.

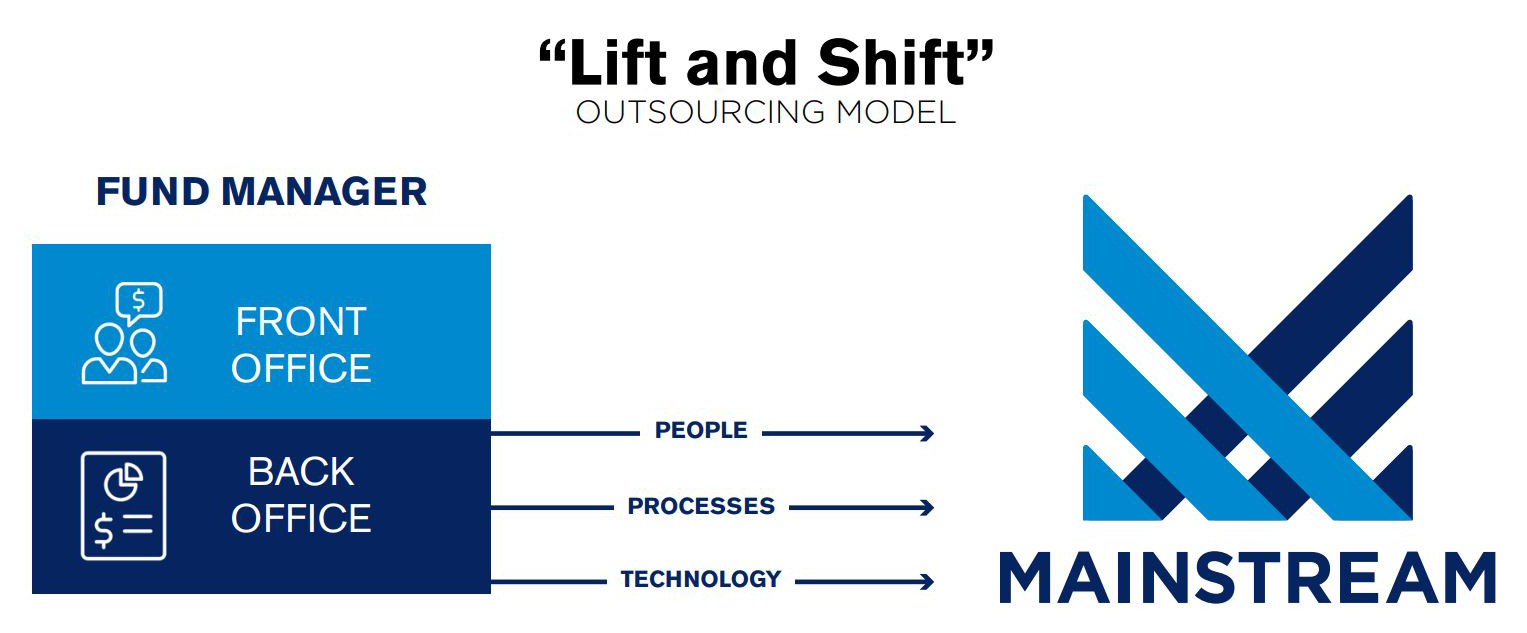

Outsourcing models

There are three main models for outsourcing fund administration functions:

- ‘Lift and shift’ model — where a service provider not only takes on the investment manager’s administration functions but also its existing technology platform, staff and processes

- Component based model — where only some of the investment manager’s existing technology platform and processes are taken on by the service provider, for example their unit registry

- Entire investment operations model — an operational strategy where all operations are outsourced at the same time

Mainstream has experience in implementing all of these models. The one most appropriate to your operations depends on your objectives.

The Mainstream enterprise solution

Mainstream has been working hard to develop its unit registry (transfer agency) capability in Australia and Asia. We are deploying automated workflow for fax, email and paper transactions, online transacting and banking automation for our clients.

Whatever your operational goals, we can partner with you to:

- Maximise operational efficiency and flexibility

- Automate workflows

- Reduce time spent reconciling and analysing data

- Improve transparency

- Lift investor service levels

- Leverage scalable technology

- Reduce costs

- Manage compliance and regulatory reporting requirements, particularly Know Your Customer (KYC) and Anti-Money Laundering (AML) obligations

Our team are leaders in implementing tailored operational models. We take a consultative approach to building you a scalable and low cost solution.

For a confidential discussion, contact us.