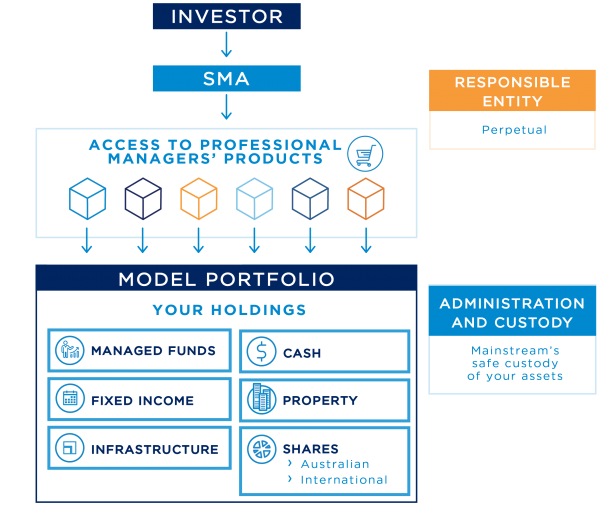

Separately Managed Accounts (SMA)

Mainstream’s SMA offers investors access to a suite of specialist Model Managers and a variety of different investment strategies

The Trust Company (RE Services) Limited, part of the Perpetual Group of companies, is the Responsible Entity for the Scheme. The Responsible Entity is responsible for the operation of the Scheme and ensures it is operated in accordance with relevant laws. Mainstream Fund Services Pty Ltd has been appointed by agreement with the Responsible Entity as both the Scheme administrator and custodian of the Scheme. As custodian for the Scheme, Mainstream is responsible for the safekeeping of assets in the portfolios. As the Scheme administrator, Mainstream provides account administration and record keeping for investors in the Scheme. This includes effecting transactions, such as buying and selling securities on your behalf for your chosen Model Portfolio. Refer to the Product Disclosure Statement for further information on our professionally managed Model Portfolios. Important Disclosure: This information is general in nature and does not consider an individual’s personal financial circumstances. Investors should consult their financial adviser and the relevant SMA product disclosure documents before considering investment in any financial product offered by Mainstream.Benefits

![]() Responsible Entity

Responsible Entity Scheme administrator and custodian

Scheme administrator and custodian

Investment Managers

If you are an investment manager who is interested in being one of our Professional Model Managers, please contact us.Disclosure documents^

^ These documents are issued by The Trust Company (RE Services) Limited ABN 45 003 278 831 Australian Financial Services Licence (AFSL) number 235150, the responsible entity for the Mainstream Separately Managed Account ARSN 631 635 473 (Scheme). The investment managers of the portfolios (Model Managers) are listed in Book 2 of this PDS. Mainstream Fund Services Pty Ltd ABN: 81 118 902 891 and AFSL number 303253 (Mainstream) is the administrator and custodian of the Scheme.