Why an integrated middle office is the next frontier for outsourced administration services

Middle office outsourcing – involving service provider integration, data and trade management, compliance and reporting – represents a new wave of specialist administration services.

While only a minority of investment managers in Asia-Pacific currently outsource their middle office functions, the position of the middle office is shifting. Operations teams are becoming more like specialist partners than service providers, with their ability to provide real-time 360 degree views of portfolio data.

Here we look at the trends emerging in middle office processing within our region and the role that specialist administrators can play.

Middle office moves out of the shadows

Many investment managers have scrambled to cut costs associated with their middle-office functions in recent years, driven by margin and competitive pressures. Alongside this, the complexity of the middle office function has increased dramatically. The traditional trade matching function now encompasses full trade, data and portfolio management functions as close to buy-side trading activities as possible. This evolution has resulted in middle office infrastructure that is unscaleable and requires significant capital investment in order to respond to product or regulatory change.

Cost cutting has also represented a missed opportunity for investment managers to transform their middle office. Institutional investors expect reduced costs, increased transparency, timely verified data and greater risk management. To meet these demands, managers are increasingly looking to third-party providers who can provide an integrated view across platforms.

Transforming the middle office through outsourcing

While many managers continue to operate with internal middle office resources, the trend is toward the use of specialist providers. Different investment managers are responding to this changing landscape in different ways.

Some managers are consolidating their service relationships with a single provider to streamline their business, bundle cost savings and reduce the burden of monitoring multiple providers. Typically these solutions are developed to solve process problems internally and tie the manager into one provider’s platform.

Other managers are going in the opposite direction, creating relationships with multiple vendors in the goal of accessing best-of-breed technology and service, whilst diversifying provider risk. However this approach can create significant integration hurdles, both in terms of data and timing.

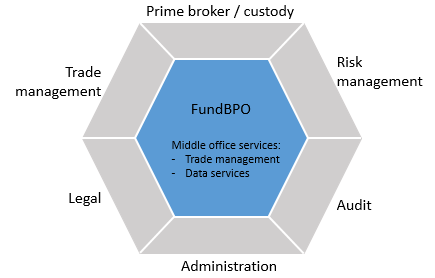

This is where FundBPO comes in, focusing on integration between our specialist product providers, such as Trading Screen’s stand-out front-end trading product, Imagines’ respected hedge fund risk analytics and management software, our administration systems, external stakeholders and the client. This naturally extends itself into the services sphere where FundBPO again works hard on achieving the integrated experience across audit, legal and prime broking providers while retaining choice for the client. This integrated approach can manage complexity while responding to new product, market and regulatory demands. It streamlines middle to back office operations into a single, transparent platform for managers to run their business and meet regulatory reporting requirements.

Gaining the full benefits of middle office innovation

Outsourcing middle office operations is no longer just about cost reduction. Investment managers need to be able to leverage their middle office so that they can grow in challenging market environments and respond to market and regulatory changes. Specialist third party middle office services have a role to play in driving benefits for investors and managers alike by creating an optimal operating and reporting environment. Managers should consider what is best for themselves and their clients when deciding between different in-house and outsourced middle office service models.

If you are interested in finding out more about FundBPO’s middle office services, please contact us.

This article is not intended to be financial advice and is of a general nature only that does not take into account your individual objectives, financial situation or needs. While all efforts have been made to ensure the information contained in this article is accurate, errors may occur.