Mainstream in Australia

Mainstream is an Australian based fund administrator for the financial services industry.

Behind the scenes we are the back office for hire – providing unit pricing and valuing assets, servicing investors (members), safeguarding assets and lodging filings – on behalf of fund managers, superannuation trustees and listed entities.

We have an established track record in Australia, preparing over 2,500 unit prices each month and providing registry services for over 96,000 unit holders.

As an Australian company, we understand the local regulatory and compliance requirements faced by our clients and their investors. We keep pace with regulatory and technological change so our clients can remain competitive, make better decisions and focus on returns.

We are known for our entrepreneurial, flexible and cost effective approach in the Australian market.

We welcome the opportunity to become your trusted fund administration partner by tailoring our service to fit your fund.

Sydney, Australia Office

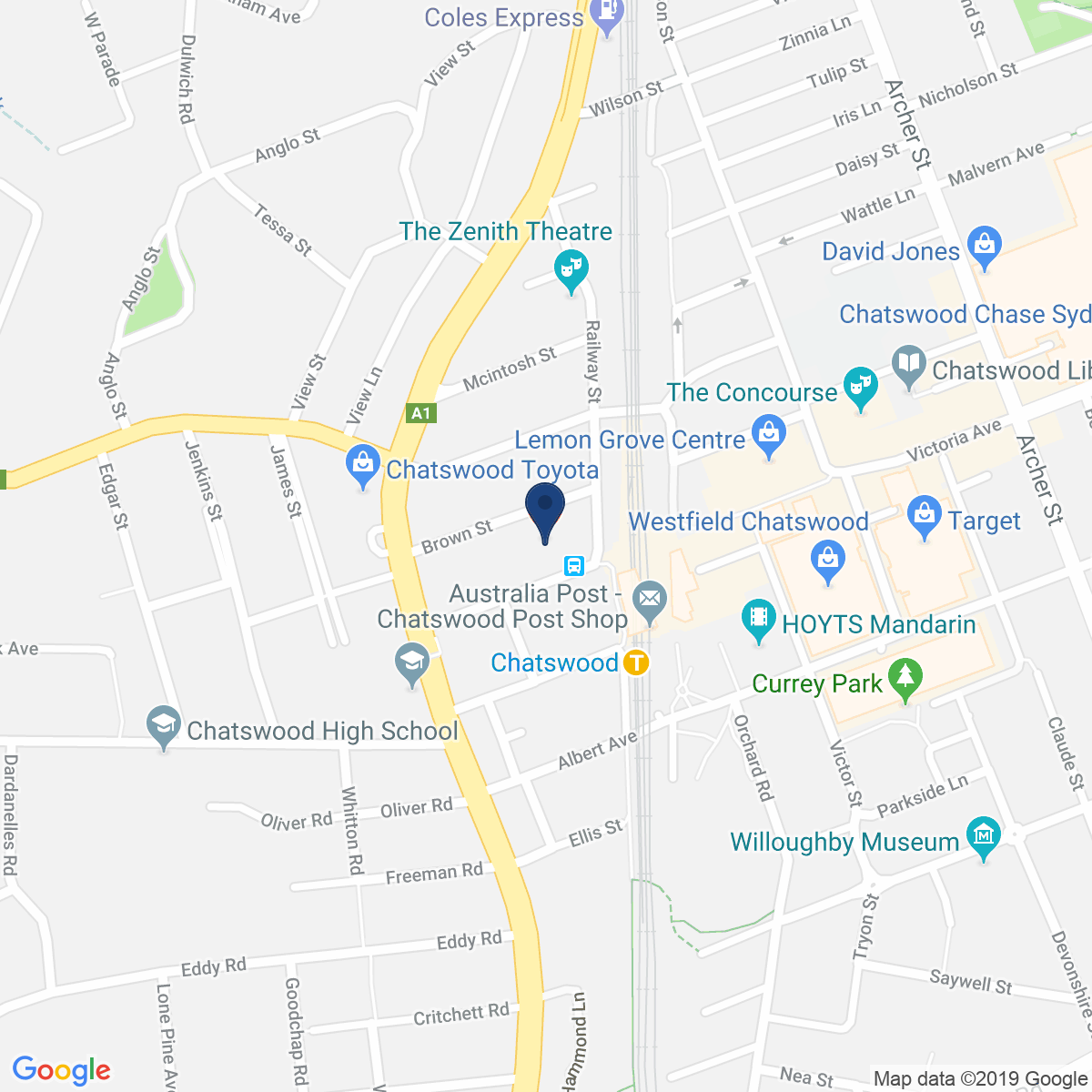

Chatswood, Australia Office

Senior Management Team

Nick Happell

Nick is the CEO of Mainstream Fund Services, Asia Pacific, responsible for building relationships with our key clients and ensuring their expectations are met. Nick has previously worked in the investment administration and Client Services team. Nick holds a Bachelor of Business from the University of Technology, Sydney.

Andy Harrison

Andy Harrison is the CEO of Mainstream Fund Services in Australia. Andy has over 16 years of experience in outsourcing, custody, fund accounting, registry, investment operations and middle and back office solutions for fund managers. Prior to joining Mainstream, Andy was CEO of Link Fund Solutions (formerly White Outsourcing). From March 2009 to December 2010, Andy was a Non-Executive Director of HUB24 (ASX:HUB). Prior to working in Australia, Andy worked in the UK with Jupiter Asset Management. He holds a Bachelor of Arts (Hons) in Business from the University of Wolverhampton.

Nicholas Bradford

Nick joined Mainstream Fund Services in 2012 to oversee Mainstream’s managed account offering. He is now responsible for developing partnerships with both new and existing business as Head of Client Services. Prior to working at Mainstream Nick worked as an academic at Macquarie University’s Faculty of Business and Economics. Nick holds a Bachelor of Economics from Macquarie University and a Masters of Economics from the University of Sydney.

Michael Garrett

Michael Garrett leads Mainstream’s Australian Unit Registry team, including Investor Services, Processing and Quality Assurance, with a focus on service delivery for our clients.

Michael Garrett has more than 20 years of experience as an operations leader, including transfer agency, trade and derivative operations, client reporting, fund administration, reconciliations, onboarding and performance. Michael was previously Head of Australian Business Operations for 12 years at Blackrock Investment Management, and has also held senior operations roles with BT Financial Group, RBC Global Services and Perpetual Fund Services.